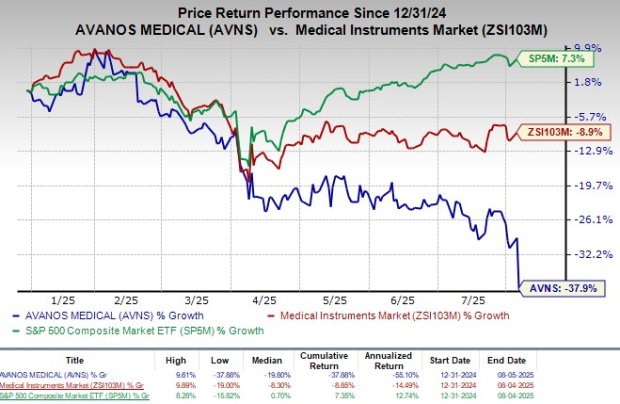

Avanos Medical Shares Drop on Disappointing Q2 Earnings and Shrinking Margins

Avanos Medical's Second-Quarter Performance

Avanos Medical, Inc. (AVNS) reported its second-quarter 2025 results, revealing a mixed performance for the company. Adjusted earnings per share (EPS) from continuing operations came in at 17 cents, representing a 50% decline compared to the same period last year. This figure fell short of the Zacks Consensus Estimate by 5.6%, signaling some disappointment among investors.

On a GAAP basis, the company recorded a loss per share from continuing operations of $1.66, down from 9 cents in the prior-year quarter. Despite this, Avanos managed to report revenue of $175 million for the quarter, reflecting a 1.9% year-over-year increase. This outperformed the Zacks Consensus Estimate by 4.7%, indicating that the company’s top line performed better than expected.

Revenue Growth and Segment Performance

The growth in revenue was primarily driven by continued strong demand and volume across Avanos’ Specialty Nutrition Systems (SNS) portfolio. Additionally, positive momentum in radiofrequency ablation (RFA) generator sales contributed to an increase in RFA procedures. However, these gains were partially offset by lower volumes in the surgical pain and recovery portfolio.

Organic sales for the quarter rose by 2% year over year, highlighting some underlying strength in the company’s core business. The SNS segment saw significant growth, with revenues reaching $102.7 million, up 5.1% compared to the previous year. This was attributed to a 4.4% volume growth, supported by strong demand in both enteral feeding and neonate solutions categories.

In the Pain Management and Recovery (PM&R) segment, revenues totaled $61 million, a 2.9% decrease year over year. While net sales of RFA products increased by 13.7% to $35.8 million, the surgical pain and recovery unit experienced a 9.4% decline in sales to $25.2 million. This decline aligned with the company’s expectations but raised concerns about the segment’s overall performance.

The Corporate and Other segment reported revenues of $11.3 million, down 23.1% year over year. This decline was largely due to pricing pressures in the hyaluronic acid (HA) injections and intravenous infusion product lines. In July, Avanos announced the divestiture of its HA product line to Channel-Markers Medical, LLC, as part of its strategic transformation to focus on PM&R and SNS segments.

Financial Performance and Margins

Avanos’ adjusted gross profit declined by 4.7% year over year to $97.4 million, with the adjusted gross margin contracting by 390 basis points to 55.7%. Selling and general expenses increased by 3.2% to $83.5 million, while research and development expenses decreased by 7.9% to $5.8 million. Adjusted operating expenses rose by 2.4% to $89.3 million.

As a result, adjusted operating profit totaled $12.2 million, a 44% decrease from the prior-year quarter. The adjusted operating margin contracted by 580 basis points to 6.9%, indicating pressure on profitability.

Financial Position and Cash Flow

At the end of the second quarter, Avanos had cash and cash equivalents of $90.3 million, slightly down from $97 million at the end of the first quarter. Total debt stood at $105.1 million, compared to $107.4 million at the end of the previous quarter.

Cumulative net cash provided by operating activities for the second quarter reached $32.5 million, an improvement from $19.8 million in the same period last year. This suggests that the company is generating more cash flow despite the challenges it faces.

Guidance and Outlook

Avanos has reiterated its full-year 2025 guidance, estimating net sales between $665 million and $685 million. The Zacks Consensus Estimate currently stands at $677.1 million. The company also expects 2025 adjusted EPS to range between 75 and 95 cents, with the Zacks Consensus Estimate at 92 cents.

Challenges and Strategic Moves

Despite the mixed results, Avanos continues to face challenges, including a volatile tariff environment in 2025. Management estimates that incremental manufacturing costs related to tariffs will amount to approximately $15 million for the year. In the second quarter alone, the company incurred over $8 million in tariffs, partly due to shipments still subject to the previous 145% tariff rate on China-origin goods.

To address these challenges, Avanos is implementing a multi-pronged strategy that includes internal cost containment, pricing actions, temporary tariff exemptions, lobbying efforts, and an accelerated plan to exit China-sourced NeoMed products by the second half of 2026.

Zacks Rank and Industry Comparison

Avanos currently holds a Zacks Rank of #3 (Hold), reflecting a neutral outlook. In comparison, several other medical companies have posted stronger results. For example:

- Medpace Holdings, Inc. (MEDP): Carries a Zacks Rank of #1 (Strong Buy), with second-quarter 2025 EPS of $3.10, beating estimates by 3.3%.

- West Pharmaceutical Services, Inc. (WST): Holds a Zacks Rank of #1, with second-quarter 2025 adjusted EPS of $1.84, exceeding estimates by 21.9%.

- Boston Scientific Corporation (BSX): Has a Zacks Rank of #2 (Buy), with second-quarter 2025 adjusted EPS of 75 cents, surpassing estimates by 4.2%.

These companies have demonstrated strong performance and are considered better alternatives in the current market environment.

Posting Komentar untuk "Avanos Medical Shares Drop on Disappointing Q2 Earnings and Shrinking Margins"

Posting Komentar