ACB Stock Drops Despite Q1 Revenue Growth Amid Missed Earnings Estimates

Financial Performance Overview

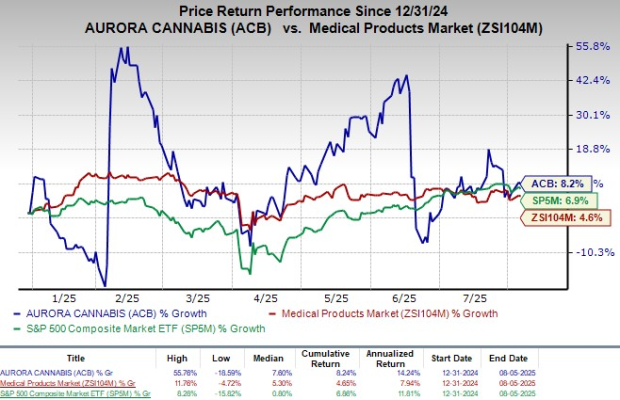

Aurora Cannabis (ACB) reported a loss per share from continuing operations of 26 cents for the first quarter of fiscal 2026, compared to an earnings per share (EPS) of 9 cents in the same period last year. This result fell short of the Zacks Consensus Estimate of 18 cents per share. The company’s stock declined by nearly 6.1% in pre-market trading, despite a year-to-date gain of 8.2%, which outperforms the industry's 4.6% growth and the S&P 500's 6.9% increase.

Revenue Growth and Strategic Shifts

Total net revenues for the quarter reached $98 million, marking a 17.5% increase year over year. This figure exceeded the Zacks Consensus Estimate by 38.3%. The revenue growth was primarily driven by strong performance in international medical cannabis markets, with higher sales to Australia, Germany, Poland, and the United Kingdom. In Canada, increased sales to insurance-covered and self-paying patients also contributed to revenue growth. The strategic focus on high-margin medical sales helped offset declines in the consumer cannabis segment, while modest gains in the plant propagation business provided additional support.

Segmental Breakdown

Global Medical Cannabis

The Global Medical Cannabis segment generated $64.8 million in revenues, a 37% increase compared to the previous year. This segment remained the company’s strongest performer, fueled by rising demand in both international and domestic markets.

International Medical Cannabis

International Medical Cannabis revenues surged by 84.7% to $37.1 million, driven by higher sales in key export markets such as Australia, Germany, Poland, and the UK. Aurora leveraged its regulatory expertise, GMP-certified facilities, and global supply chain to meet growing patient demand.

Canadian Medical Cannabis

Canadian Medical Cannabis revenue totaled $27.7 million, up 2.1% year over year. Growth was supported by increased purchasing from insurance-covered and self-paying patients, along with operational efficiency that maintained the segment’s strong margin profile.

Consumer Cannabis

Consumer cannabis revenue declined by 32% to $7.9 million, due to the company’s decision to prioritize high-margin global medical cannabis over lower-margin consumer products. The Wholesale Bulk Cannabis segment saw a modest increase, recording $1.43 million in net revenue compared to $0.83 million in the prior-year period.

Plant Propagation

Plant propagation revenue came entirely from the Bevo business, contributing $23.9 million, a 3.8% increase from the previous year. This growth resulted from organic expansion and increased production capacity.

Financial Metrics and Outlook

Gross profit for the quarter declined by 34.9% to $27.9 million, but the adjusted gross margin improved by 1000 basis points to 52%. Selling and marketing expenses rose by 3.1% to $14.5 million, while general and administrative expenses increased by 25.8% to $28.6 million. Research and development expenses decreased by 16% to $0.8 million. Total operating expenses reached $48.2 million, a 9.7% increase year over year.

Operating loss for the quarter was $20.2 million, compared to $0.9 million in the prior-year quarter. The company ended the first quarter of fiscal 2026 with cash and cash equivalents of $140.2 million, up slightly from $137.9 million at the end of fiscal 2025. Net cash provided by operating activities was $10.1 million, compared to $8.3 million in the same period last year.

Guidance and Future Expectations

Aurora Cannabis expects consolidated net revenue to grow in the fiscal second quarter of 2026, with Global Medical Cannabis revenue anticipated to increase by 8%-12%. The Plant Propagation segment is expected to follow traditional seasonal trends, with 25%-35% of annual propagation revenue typically earned in the second half of the calendar year. The company also anticipates positive free cash flow for the full year.

Zacks Rank and Industry Comparison

ACB currently carries a Zacks Rank of #4 (Sell). In contrast, other companies in the broader medical space have shown stronger performance. Medpace Holdings (MEDP), West Pharmaceutical Services (WST), and Boston Scientific (BSX) all carry higher Zacks Ranks, indicating more favorable investment outlooks. These companies have consistently exceeded earnings estimates and demonstrated strong growth potential.

Posting Komentar untuk "ACB Stock Drops Despite Q1 Revenue Growth Amid Missed Earnings Estimates"

Posting Komentar