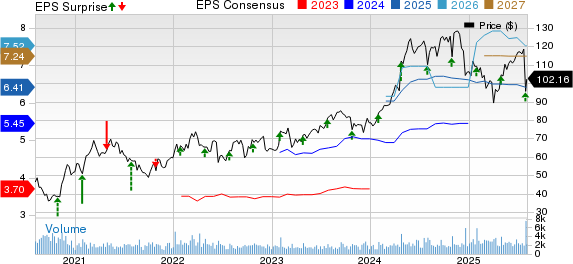

Kirby Surges 7.2% Since Q2 Earnings, Revenue Rises Year-Over-Year

Shares of Kirby Corporation (KEX) have seen a significant increase of 7.2% since the release of its second-quarter 2025 earnings on July 31, 2025. This positive movement is largely due to the company's better-than-expected performance in the quarter. The quarterly earnings came in at $1.67 per share, surpassing the Zacks Consensus Estimate of $1.59 and showing a 17% year-over-year improvement. However, total revenues for the quarter reached $855.5 million, which fell slightly short of the Zacks Consensus Estimate of $885 million, but still reflected a 3.7% growth compared to the same period last year.

David Grzebinski, CEO of Kirby Corporation, commented on the results, stating, “Kirby delivered another solid quarter, with strong performance across both marine transportation and distribution and services. Our teams executed well in a dynamic environment, and we continued to benefit from healthy customer demand, disciplined pricing, and operational focus.”

Q2 Segmental Performance of KEX

Kirby Corporation operates through two main segments: marine transportation and distribution and services.

Marine Transportation Revenues

In the second quarter, marine transportation revenues totaled $492.6 million, marking a 1.5% year-over-year increase. Operating income rose to $99.1 million from $94.9 million in the previous year’s quarter, with the segment operating margin improving to 20.1% from 19.6%.

The inland market saw average barge utilization in the low to mid-90% range during the quarter. Spot market rates increased by low single digits sequentially and mid-single digits year over year. Term contracts renewed during the quarter showed an average growth of low to mid-single digits. Inland operations accounted for 81% of the segment’s revenue, with an operating margin in the low 20% range.

Coastal operations maintained solid market conditions, with barge utilization in the mid to high-90% range. Term contract renewals grew by an average of mid-20% year over year. Coastal revenues increased by 3% year over year, driven by higher pricing, although this was partially offset by elevated planned shipyard activity. Coastal revenues made up 19% of the marine transportation segment, with an operating margin in the high teens.

Distribution and Services Revenues

For the second quarter of 2025, distribution and services revenues reached $362.89 million, a 6.9% increase year over year. Operating income for the quarter was $35.4 million, compared to $29.4 million in the prior year. The operating margin improved to 9.8% from 8.7% in the previous year.

Power generation revenues rose by 31% year over year, supported by robust sales. Orders continued to grow as the need for 24/7 power and backup capabilities remained critical. Power generation accounted for 39% of segment revenues, with operating margins in the mid to high single digits.

Commercial and industrial revenues and operating income grew by 5% and 24%, respectively, due to strong activity levels in marine repair and modest improvements in on-highway repair business. These segments accounted for 48% of the segment’s revenue, with operating margins in the low double digits.

Oil and gas revenues declined by 27% year over year, while operating income surged by 182%. This was due to lower conventional oilfield activity, leading to reduced demand for new transmissions and parts. However, deliveries of e-frac equipment helped offset some of the decline. Oil and gas revenues represented 13% of the segment’s total, with operating margins in the low double digits.

Balance Sheet Highlights & Cash Flow

As of June 30, 2025, Kirby had cash and cash equivalents totaling $68.38 million, compared to $51.1 million at the end of the previous quarter. During the reported quarter, KEX generated $94 million in net cash from operating activities, with capital expenditures reaching $71.5 million. The company also repurchased 331,900 shares at an average price of $94.01, amounting to $31.2 million.

KEX’s 2025 Outlook

For 2025, Kirby anticipates a 15-25% year-over-year growth in earnings. Under the Marine Transportation segment, inland marine barge utilization has softened slightly to the low 90% range for the third quarter. Pricing improvements in term contracts are expected to continue long-term, though spot market pricing may face pressure due to short-term demand softness. Operating margins are expected to remain in the 20% range, assuming no major disruptions.

In coastal marine, market fundamentals remain strong, with contract renewals robust and improved operating leverage as shipyard activity declines. Coastal barge utilization is expected to stay in the mid-90% range. Limited vessel availability and strong customer demand are driving continued pricing momentum. Operating margins are anticipated to be in the mid to high teens range, with modest improvement in the back half of the year.

In the distribution and services segment, the outlook is mixed. Power generation remains a strength, with solid demand from data centers and industrial customers. Commercial and industrial activity is steady, and the on-highway market has shown modest improvement. Oil and gas growth is constrained due to current market conditions, but strength is seen in e-frac and cost management. Full-year revenues for the segment are expected to be flat to slightly up, with operating margins in the high-single digits.

Net cash flow from operating activities is projected to be between $620 million and $720 million. Capital expenditures are now expected to be between $260 million and $290 million, compared to the previous estimate of $280 million to $320 million.

Currently, Kirby carries a Zacks Rank #5 (Strong Sell).

Q2 Performances of Other Transportation Companies

Delta Air Lines (DAL) reported second-quarter 2025 earnings (excluding $1.17 per share from non-recurring items) of $2.10 per share, beating the Zacks Consensus Estimate of $2.04. Earnings decreased by 11% year over year due to high labor costs. Revenues for the June-end quarter were $16.65 billion, exceeding the Zacks Consensus Estimate of $16.2 billion but decreasing marginally year over year.

J.B. Hunt Transport Services, Inc. (JBHT) reported second-quarter 2025 earnings of $1.31 per share, missing the Zacks Consensus Estimate of $1.34 and declining by 0.8% year over year. Total operating revenues of $2.93 billion missed the Zacks Consensus Estimate of $2.94 billion and were flat year over year. Despite increases in Intermodal loads, Truckload loads, and Integrated Capacity Solutions revenue per load, these gains were offset by declines in Final Mile Services revenue and other factors.

United Airlines Holdings, Inc. (UAL) reported mixed results for the second quarter of 2025. Adjusted earnings per share of $3.87 surpassed the Zacks Consensus Estimate by a penny but declined by 6.5% year over year. Operating revenues of $15.2 billion fell short of the Zacks Consensus Estimate of $15.4 billion but increased by 1.7% year over year. Passenger revenues, which made up 90.8% of the top line, rose by 1.1% year over year to $13.8 billion. UAL transported 46,186 passengers in the second quarter, an increase of 4.1% year over year.

Posting Komentar untuk "Kirby Surges 7.2% Since Q2 Earnings, Revenue Rises Year-Over-Year"

Posting Komentar