MARA Holdings Hits Record Profits from Bitcoin Surge

MARA Holdings Reports Strong Q2 Performance Amid Crypto Volatility

MARA Holdings delivered a mixed performance in its recent quarterly report, with notable contrasts between GAAP and non-GAAP results. The company reported a loss of 81 cents per share, which widened compared to the Zacks Consensus Estimate of a 53-cent loss. This is a significant increase from the 24-cent loss recorded in the same quarter last year. However, on a GAAP basis, MARA showed impressive gains, reporting an EPS of $1.84. This marks a substantial improvement from the 72-cent loss seen a year ago and far exceeded the consensus expectation of a 19-cent loss.

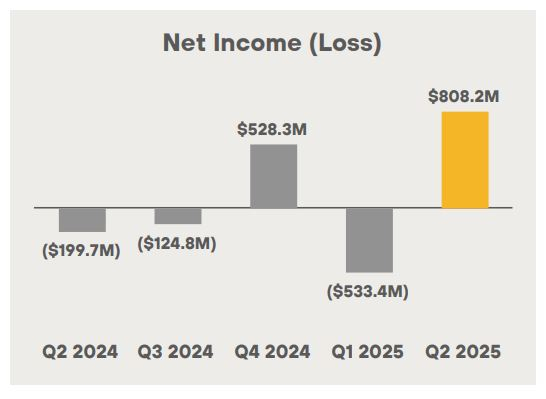

The positive GAAP results were largely driven by a $1.2 billion gain from the fair value of digital assets, reflecting the growing value of MARA’s Bitcoin holdings as crypto prices surged. Net income skyrocketed to $808.2 million, representing a 505% increase year over year. This marked the most profitable quarter in the company's history. Adjusted EBITDA also saw a dramatic rise, reaching $1.25 billion, reversing a $483.6 million loss from the previous quarter and outpacing the $125.5 million loss in the year-ago quarter.

Mining Milestones Highlight Operational Strength

MARA’s revenue growth was equally impressive, surging 64% year over year to $238.5 million. This exceeded estimates and set a new all-time high for the company. The increase was fueled by mining 2,358 BTC during the quarter, a 3% increase from the first quarter and significantly higher than the year-ago period. Block production also saw a major boost, rising 52% to 694 blocks, including the highest number of blocks mined in a single month in May.

Efficiency improvements were also notable. The company’s hashrate increased to 57.4 exahashes per second (EH/s), up 82% from 31.5 EH/s a year ago and 6% sequentially. MARA deployed 30,000 new miners with top-tier energy efficiency of 18.3 joules per terahash (J/TH), reinforcing its focus on sustainable scaling.

Cost metrics improved across the board. The cost per petahash per day dropped 24% year over year to $28.7, while purchased energy cost per Bitcoin declined by 5.6% since the first quarter, to $33,735. Energy costs at MARA’s owned sites remained low at just $0.04 per kWh, showcasing the company’s operational discipline.

Balance Sheet Strengthens for Future Expansion

At the end of the quarter, MARA held a massive 49,951 BTC, including Bitcoin loaned, actively managed, and pledged as collateral. Combined with unrestricted cash and equivalents, the company’s total liquidity reached an impressive $5.4 billion. This financial strength gives MARA flexibility to maneuver aggressively in the crypto economy.

Further bolstering its position, MARA closed a $950 million upsized 0.00% Convertible Senior Notes offering due in 2032 and repurchased $19.4 million in 1% Senior Notes due 2026 at a discount. These moves reflect prudent capital structuring and opportunistic financing to support both short-term needs and long-term growth.

The company’s trailing 12-month adjusted Return on Capital Employed came in at 27%, highlighting its efficient capital reinvestment strategy. As a crypto miner with an asset-light monetization model, MARA’s ability to generate high returns while maintaining operational agility is a key competitive advantage.

Looking ahead, the added funds position MARA to strategically invest in more Bitcoin, explore M&A opportunities, and consider potential debt buybacks. These steps lay the foundation for sustained expansion, even in unpredictable market conditions.

Recent Earnings Highlights

In addition to MARA’s strong performance, several other companies released their earnings reports:

-

Fiserv reported mixed second-quarter 2025 results, with earnings beating the Zacks Consensus Estimate but revenues missing the mark. Adjusted EPS of $2.47 topped expectations by 2.5% and rose 16% year over year, while adjusted revenues of $5.2 billion fell slightly short of estimates.

-

The Interpublic Group of Companies (IPG) delivered impressive results, with both earnings and revenues exceeding the Zacks Consensus Estimate. Adjusted earnings of 75 cents per share surpassed expectations by 36.4% and jumped 23% from the year-ago quarter. Net revenues of $2.2 billion beat estimates, though total revenues declined year over year.

Posting Komentar untuk "MARA Holdings Hits Record Profits from Bitcoin Surge"

Posting Komentar