NRG Energy Surpasses Earnings Estimates as Revenues Rise Year-over-Year

NRG Energy's Strong Performance in Q2 2025

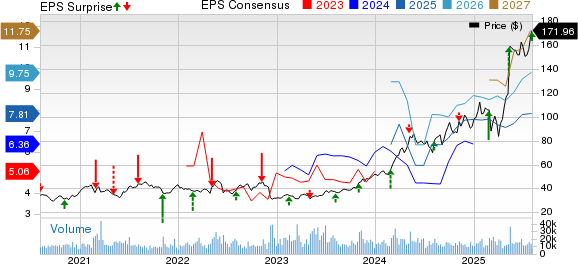

NRG Energy, Inc. delivered impressive results for the second quarter of 2025, with earnings per share (EPS) reaching $1.68, surpassing the Zacks Consensus Estimate of $1.54 by 9.1%. This marks a significant improvement from the $1.48 EPS reported in the same period of 2024. The company’s strong performance highlights its ability to exceed expectations despite challenging market conditions.

Revenue Growth and EBITDA Analysis

Total revenues for the quarter amounted to $6.74 billion, significantly outperforming the Zacks Consensus Estimate of $6.02 billion by 12%. This represents a 1.2% increase compared to the $6.66 billion recorded in the second quarter of 2024. The revenue growth underscores NRG’s effective management of its operations and its ability to capitalize on market opportunities.

However, the company’s adjusted EBITDA for the quarter was $909 million, a decrease of 5.5% compared to $962 million in the same period last year. This decline can be attributed to rising operating costs and expenses, which totaled $6.74 billion—up 28.3% from $5.25 billion in the previous year’s quarter. Despite this, the company remains focused on long-term value creation through strategic financial decisions.

Share Repurchases and Dividends

As of July 31, 2025, NRG completed $768 million in share repurchases and distributed $173 million in common stock dividends. For the full year of 2025, the company plans to return approximately $1.3 billion to shareholders through a combination of share repurchases and dividends, with an estimated $345 million allocated for common stock dividends. These actions reflect NRG’s commitment to rewarding its investors while maintaining a strong balance sheet.

Financial Highlights and Balance Sheet Position

As of June 30, 2025, NRG had cash and cash equivalents totaling $180 million, down from $966 million as of December 31, 2024. This reduction is primarily due to the company’s investment in share repurchases and dividend distributions. Meanwhile, long-term debt and finance leases remained stable at $9.81 billion, consistent with the level reported at the end of 2024.

Cash provided by operating activities for the first six months of 2025 reached $1.31 billion, slightly lower than the $1.32 billion recorded in the same period of 2024. Capital expenditures for the period were $595 million, compared to $172 million in the prior-year quarter, reflecting increased investments in infrastructure and growth initiatives.

2025 Guidance and Outlook

Looking ahead, NRG Energy has provided updated guidance for 2025. The company expects adjusted net income to range between $1.33 billion and $1.53 billion, with adjusted EPS expected to fall within $6.75 to $7.75. Free cash flow before growth is projected to be between $1.975 billion and $2.225 billion, while adjusted EBITDA is anticipated to be in the range of $3.725 billion to $3.975 billion.

These projections indicate that NRG remains confident in its ability to deliver consistent performance amid evolving market dynamics.

Zacks Rank and Market Position

Currently, NRG Energy holds a Zacks Rank of #3 (Hold), indicating a neutral outlook from analysts. While the company is not considered a strong buy at this time, its solid fundamentals and strategic initiatives position it well for future growth.

Other Energy Sector Performances

In addition to NRG Energy’s results, other major energy companies also reported their Q2 2025 earnings:

-

American Electric Power Company, Inc. (AEP): AEP posted operating EPS of $1.43, exceeding the Zacks Consensus Estimate of $1.28 by 11.7%. Revenues rose 11.1% year over year to $5.09 billion.

-

CMS Energy Corporation: CMS reported EPS of 71 cents, beating the Zacks Consensus Estimate of 67 cents by 6%. Operating revenues reached $1.84 billion, up 14.4% from the previous year.

-

NextEra Energy, Inc. (NEE): NEE’s adjusted earnings of $1.05 per share exceeded the Zacks Consensus Estimate of $1.02 by 2.9%. However, operating revenues fell short of expectations at $6.7 billion, missing the estimate of $7.22 billion by 7.28%.

These results highlight the diverse performance across the energy sector, with some companies outperforming while others face headwinds.

Posting Komentar untuk "NRG Energy Surpasses Earnings Estimates as Revenues Rise Year-over-Year"

Posting Komentar