PLTR Surges: AI-Powered Quarter Shocks Wall Street

Palantir Technologies Surpasses Expectations with Record-Breaking Q2 2025 Results

Palantir Technologies has once again proven its strength in the market, delivering a second-quarter 2025 earnings report that exceeded all expectations. The company not only surpassed revenue and earnings forecasts but also achieved a significant milestone: its first-ever billion-dollar quarter. This accomplishment highlights the company’s growing influence in the artificial intelligence (AI) sector and its ability to meet the rising demand from both government and commercial clients.

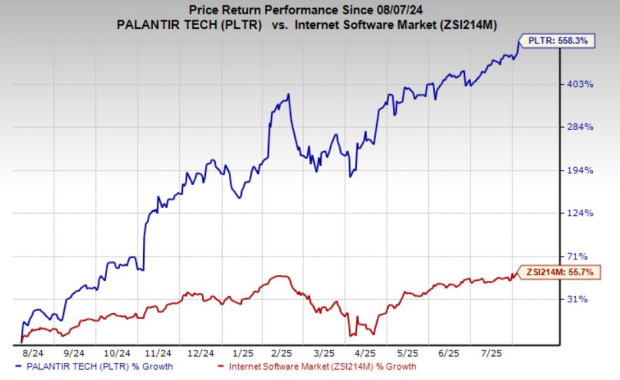

The success of Palantir can be attributed to its rapidly expanding Artificial Intelligence Platform (AIP), which is driving growth across multiple industries. With a strong focus on AI deployment rather than just model development, the company is setting itself apart in a competitive landscape. The positive momentum has led to an all-time high for its stock, reaching $176.33 in recent trading. Shares have more than doubled year-to-date and have seen over a 500% increase in the past 12 months, solidifying Palantir as a top AI stock to watch.

A Record-Breaking Quarter

In the second quarter of 2025, Palantir reported revenues of $1 billion, marking a 48% year-over-year increase. This figure easily surpassed the Zacks Consensus Estimate of $938.3 million, making it the first time the company crossed the $1 billion quarterly revenue threshold. Earnings per share came in at 16 cents, beating expectations by 2 cents and showing a 78% increase compared to the same period last year. Adjusted EBITDA reached $470.9 million, up 69% from the previous year, with a strong adjusted EBITDA margin of 47%, representing an 800 basis point improvement year over year.

The U.S. market remains a key driver of growth, with U.S. revenues jumping 68% year over year to $733 million. Within this, U.S. commercial revenues surged 93% to $306 million, while U.S. government business rose 53% to $426 million. CEO Alex Karp described the quarter as “phenomenal,” noting that the company achieved a Rule of 40 score of 94%, an elite benchmark in the software industry. This score reflects a healthy balance between revenue growth and profitability.

AIP: The Engine Behind Growth

At the heart of Palantir’s success is its Artificial Intelligence Platform (AIP), which is becoming a critical component of its commercial expansion. In the first quarter alone, U.S. commercial revenue increased by 71% year over year and reached the $1 billion annual run rate. This momentum continued into the second quarter, with U.S. commercial growth hitting 93% year over year.

AIP allows clients to integrate autonomous AI agents directly into their workflows, enabling faster decision-making and significant productivity improvements. Unlike many competitors focused on AI model development, Palantir excels in deployment, offering enterprise-ready solutions that are immediately usable. The company’s AIP bootcamps—intensive implementation workshops—have played a vital role in accelerating adoption, helping clients move quickly from onboarding to production deployment.

Strong Guidance and Future Outlook

Following the record-breaking quarter, Palantir raised its full-year 2025 revenue guidance to a range of $4.14 to $4.15 billion, up from a prior estimate of $3.90 billion. For the third quarter of 2025, the company expects revenues of about $1.085 billion, surpassing current consensus estimates of $989.44 million. If achieved, this would represent the highest sequential revenue growth in Palantir’s history.

Additionally, Palantir forecasts adjusted income from operations between $1.91 billion and $1.92 billion for the year. Adjusted free cash flow is projected between $1.8 billion and $2 billion, providing flexibility for expansion and research and development. The company ended the quarter with $929.5 million in cash and equivalents, despite a decrease from $2.1 billion at the end of 2024 due to ongoing investments. Operating cash flow for the quarter was a healthy $539.3 million, reflecting the firm’s profitability and operational efficiency.

AI Market Landscape and Key Players

Palantir’s performance aligns with the broader AI surge, which has lifted peers like NVIDIA (NVDA). While NVDA continues to dominate the AI infrastructure space, other companies such as C3.ai (AI) have struggled, with their stock down 32% year to date. As the AI landscape evolves, Palantir’s focus on delivering tangible AI solutions sets it apart, positioning it as a leader in the field.

For investors, the interplay between Palantir, NVIDIA, and C3.ai offers a compelling view of the AI revolution. While each company plays a different role in the ecosystem, the overall trend points to a future where AI will continue to reshape industries and drive innovation.

Posting Komentar untuk "PLTR Surges: AI-Powered Quarter Shocks Wall Street"

Posting Komentar