Q2 Earnings Surprise: Issuer Solutions Lead the Way

Strong Performance in Q2 2025 for Global Payments Inc

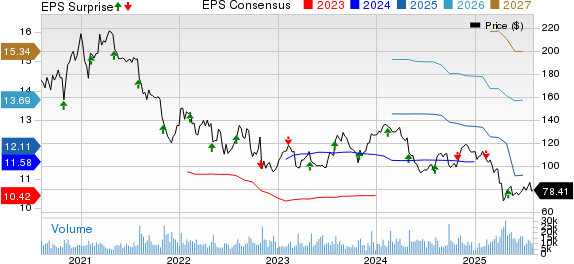

Global Payments Inc. (GPN) delivered impressive results for the second quarter of 2025, surpassing expectations across several key metrics. The company reported adjusted earnings per share (EPS) of $3.10, exceeding the Zacks Consensus Estimate of $3.03 by a notable margin. This represents an 11% year-over-year increase, highlighting the company’s strong financial position.

Adjusted net revenues for the quarter reached $2.4 billion, marking a 2% year-over-year growth. This figure also surpassed the consensus estimate by 0.2%, further underscoring the positive performance. The improvement was driven by the continued strength in both the Merchant Solutions and Issuer Solutions segments, although some of the gains were partially offset by higher operating expenses.

Operating Performance and Margin Expansion

The company's adjusted operating income for the quarter stood at $1.1 billion, reflecting a 4.5% increase compared to the same period in 2024. Additionally, the adjusted operating margin expanded by 130 basis points (bps), reaching 44.6%. This margin expansion is a clear indicator of improved operational efficiency and cost management.

Total operating expenses for the quarter amounted to $1.5 billion, an increase of 2.3% from the previous year. This rise was primarily attributed to higher selling, general, and administrative expenses. Interest and other expenses also increased by 2.7% year over year, reaching $152.2 million.

Segmental Performances

Merchant Solutions

The Merchant Solutions segment recorded adjusted revenues of $1.8 billion in the second quarter, representing a 1.1% year-over-year increase. This exceeded the Zacks Consensus Estimate by 0.7%. Adjusted operating income for this segment rose by 3.7% to $917.3 million, outperforming the estimated $902.5 million.

Issuer Solutions

In the Issuer Solutions segment, adjusted revenues totaled $547.4 million, reflecting a 4% year-over-year growth. This also beat the Zacks Consensus Estimate by 1.1%. Adjusted operating income for the segment increased by 8% year over year to $266.4 million, surpassing the expected $255.7 million.

Financial Position and Cash Flow

As of June 30, 2025, Global Payments Inc. held cash and cash equivalents of $2.6 billion, up from $2.4 billion at the end of 2024. Total assets reached $48.5 billion, an increase from $46.9 billion at the end of the previous year. Long-term debt decreased to $14.2 billion from $15.1 billion, with the current portion of long-term debt standing at $1.9 billion.

Total equity rose to $23.2 billion, compared to $22.9 billion at the end of 2024. Operating cash flows for the second quarter amounted to $818 million, up from $736.9 million in the same period last year.

Capital Deployment and Dividend

During the first half of 2025, GPN repurchased shares worth $691.1 million. The company also declared a quarterly dividend of 25 cents per share, set to be paid on September 26, 2025, to shareholders of record as of September 12.

2025 Outlook and Expectations

Global Payments Inc. has reaffirmed its 2025 outlook, projecting constant currency adjusted net revenue growth between 5% and 6%. Adjusted EPS growth is expected to range between 10% and 11%. The company continues to anticipate converting nearly 90% of adjusted net income into adjusted free cash flow. Additionally, the annual adjusted operating margin is now expected to increase by more than 50 bps in 2025.

Zacks Rank and Market Comparison

GPN currently holds a Zacks Rank of #3 (Hold). In the business services space, several stocks have a stronger Zacks Rank. Coherent Corp (COHR), APi Group Corp (APG), and Evertec Inc (EVTC) each carry a Zacks Rank of #1 (Strong Buy). These companies have seen positive revisions in their earnings estimates and have consistently beaten expectations in recent quarters.

For example, Coherent Corp has seen three upward revisions in its current-year earnings estimate, with an average earnings surprise of 15.2% over the past four quarters. APi Group Corp has also had three upward revisions, with an average earnings surprise of 4.3%. Evertec Inc has consistently beaten earnings estimates, with an average surprise of 12.4%.

These comparisons highlight the competitive landscape in the business services sector and provide investors with valuable insights into potential investment opportunities.

Posting Komentar untuk "Q2 Earnings Surprise: Issuer Solutions Lead the Way"

Posting Komentar