SNAP Earnings Fall Short in Q2, Revenues Rise Year-Over-Year

Financial Performance in Q2 2025

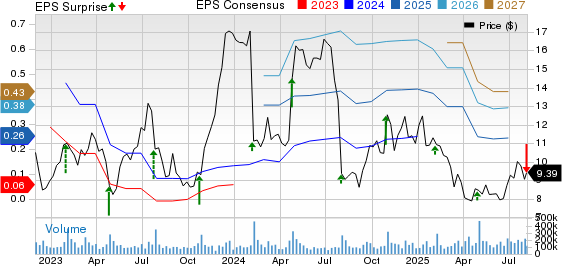

Snap Inc. reported a loss of one cent per share for the second quarter of 2025, which fell short of the Zacks Consensus Estimate of one cent per share. This result contrasts with the company's earnings of two cents per share during the same period in 2024. Despite the loss, revenue saw an increase of 8.7% year over year, reaching $1.35 billion, surpassing the Zacks Consensus Estimate by 0.66%.

Revenue Breakdown by Region

North America contributed 61% of total revenues, amounting to $820.6 million, representing a 6.9% increase from the previous year. Europe accounted for 19.7% of total revenues, rising to $265.34 million, a 15.4% growth compared to the prior year. The Rest of the World (ROW) segment recorded $258.99 million, marking an 8.2% year-over-year increase.

The average revenue per user (ARPU) increased by 0.3% to $2.87. North America and Europe saw ARPU increases of 8.6% and 12.3%, respectively, while the ROW segment experienced a decline of 5.9% in ARPU.

User Engagement and Growth

Snap’s global community reached 469 million daily active users (DAU) in the second quarter, showing an 8.6% year-over-year growth. On a quarter-over-quarter basis, the company added 9 million DAU. North America had 98 million DAU, a 2% decrease from the previous year. Europe recorded 100 million DAU, a 3.1% increase. The ROW segment saw a significant jump of 15.3% in DAU, reaching 271 million. Monthly active users exceeded 932 million in the quarter.

Snapchat+ reached nearly 16 million subscribers in Q2, driving a 64% year-over-year increase in other revenue, which now has an annualized run rate of almost $700 million. To build on this success, Snap introduced Lens+, a new subscription tier offering exclusive AI video Lenses, Bitmoji Game Lenses, and early access to new features.

Advertising Performance

Snap's advertising platform showed strong performance in Q2, driven by enhanced AI capabilities and optimization tools. Commerce advertisers saw a 39% increase in purchase volume year over year, while total purchase-related advertising revenues grew more than 25% from the prior year. Sponsored Snaps proved effective, generating up to 22% higher conversion rates when integrated into broader campaigns and delivering an 18% improvement in unique converters for app installations and in-app purchases.

Operating Expenses and EBITDA

Adjusted cost of revenues rose 11% year over year to $650.1 million. Adjusted operating expenses were $631.1 million, an increase of 2.2% compared to the previous year. Sales and marketing expenses decreased by 2% to $202.2 million, while general and administrative expenses dropped 10.5% to $183.8 million. Research and development expenses climbed 18.9% to $245.1 million. Adjusted EBITDA was $41.3 million, down 24.9% from the year-ago quarter, reflecting slower revenue growth and increased investment spending that offset operational improvements.

Balance Sheet and Cash Flow

As of June 30, 2025, cash and cash equivalents, along with marketable securities, totaled $2.9 billion, down from $3.2 billion as of March 31, 2025. Operating cash flow was $88.4 million, compared to a negative cash flow of $21.3 million in the prior year. Free cash flow was $23.7 million, improving from a negative $73.4 million in the same period last year.

Guidance for Q3 2025

Snap expects third-quarter DAU to reach 476 million and projects revenues between $1.48 billion and $1.51 billion. The company maintains its full-year guidance for infrastructure costs per DAU at 82-87 cents per quarter and anticipates operating in the top half of this range for Q3. Snap continues to prioritize investments in machine learning and AI infrastructure. EBITDA is expected to be between $110 million and $135 million in the third quarter.

Zacks Rank and Other Stocks to Consider

Snap currently holds a Zacks Rank of #2 (Buy). Other top-ranked stocks in the Zacks Computer and Technology sector include StoneCo, STNE, Applied Materials (AMAT), and Cisco Systems (CSCO). StoneCo carries a Zacks Rank of #1 (Strong Buy), while AMAT and CSCO both have a Zacks Rank of #2. These companies are set to report their quarterly results in the coming weeks.

Posting Komentar untuk "SNAP Earnings Fall Short in Q2, Revenues Rise Year-Over-Year"

Posting Komentar