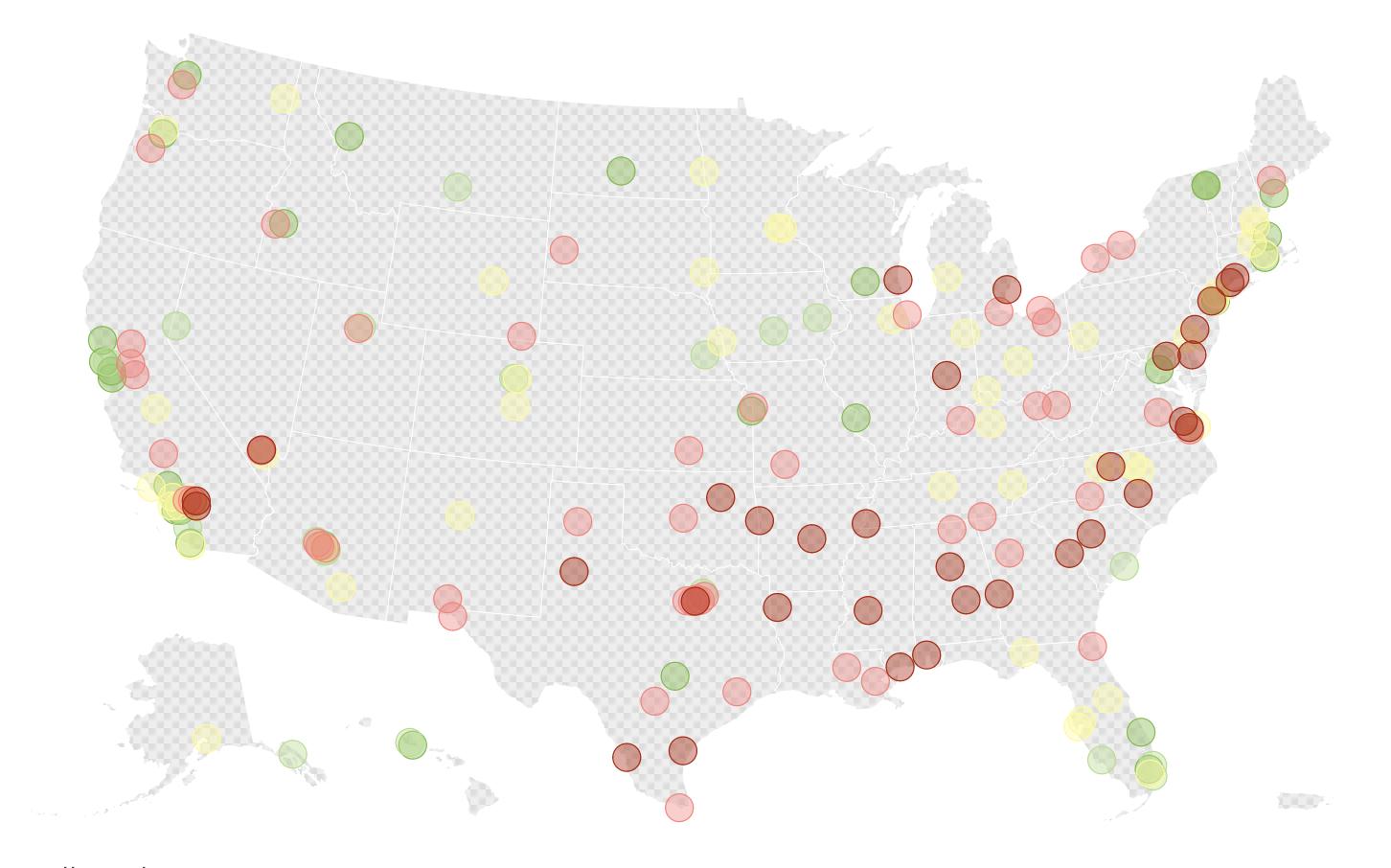

Map reveals cities with top and bottom credit scores

Understanding the Variability of Credit Scores Across U.S. Cities

Credit scores play a significant role in shaping the financial lives of Americans, often serving as a key indicator of their overall financial health. A recent ranking by personal finance firm WalletHub highlights the stark differences in credit scores across more than 150 U.S. cities, revealing how location can significantly impact these crucial numbers.

South Burlington, Vermont, tops the list with an average credit score of 701, which falls into the "Very Good" category. This is followed closely by Fremont, California, with a median score of 688, and Scottsdale, Arizona, at 686. San Francisco and Huntington Beach both have average scores of 685 and 682, respectively, placing them in the "Good" range.

The analysis of the top 25 cities shows a strong presence of California cities, with eight of them making the list. These include Fremont, San Francisco, Huntington Beach, Santa Clarita, San Jose, Irvine, San Diego, and Santa Rosa. In addition to California, Vermont and Florida each have two cities in the top 25: South Burlington and Burlington for Vermont, and Port St. Lucie and Pembroke Pines for Florida.

However, not all cities are faring as well. Birmingham, Alabama, has an average credit score of 593, while San Bernardino, California, and Newark, New Jersey, both have scores of 592 and 591, respectively. Memphis, Tennessee, rounds out the lower end with a score of 590. At the bottom of the list is Detroit, Michigan, with an average credit score of 566, which places it in the "Poor" range. These low scores suggest that residents may face challenges such as higher interest rates and stricter lending conditions.

The cities with the lowest credit scores are concentrated in the southeastern and south-central parts of the United States. Texas leads the way in this category, with four cities—Laredo, Corpus Christi, Lubbock, and Grand Prairie—falling into the bottom 25. Alabama follows with three cities: Birmingham, Montgomery, and Mobile. Mississippi, Georgia, and Arkansas each have two cities in the bottom 25.

The Importance of Credit Scores

Credit scores are essential because they are often the first factor lenders consider when evaluating applications for mortgages, car loans, or credit cards. Most U.S. lenders use either FICO Scores or VantageScore, both of which range from 300 to 850. Higher scores are generally better, though the categories differ slightly between the two systems.

FICO categorizes scores between 300 and 579 as "Poor," 580 to 669 as "Fair," 670 to 739 as "Good," 740 to 799 as "Very Good," and 800 to 850 as "Exceptional." VantageScore uses different labels, with 300 to 499 considered "Very Poor," 500 to 600 as "Poor," 601 to 660 as "Fair," 661 to 780 as "Good," and 781 to 850 as "Excellent."

The difference between these categories is not just academic. Borrowers with "Exceptional" credit can qualify for the lowest interest rates, potentially saving tens of thousands of dollars over the life of a mortgage compared to someone with a "Poor" score. Additionally, credit history can influence decisions made by landlords, insurers, and even some employers, meaning the impact of a credit score extends beyond just borrowing.

Tips for Improving Your Credit Score

Improving your credit score largely depends on maintaining consistent financial habits. Here are some effective strategies:

- Pay bills on time: Always make payments by the due date, ideally through automatic payments to avoid late fees.

- Keep credit utilization low: Aim to use less than 30% of your available credit limit, with an ideal range closer to 1 to 10%.

- Review credit reports regularly: Check for errors and dispute any inaccuracies that could negatively affect your score.

- Avoid opening too many accounts: Each new account application results in a hard inquiry, which can temporarily lower your score.

By following these steps, individuals can take proactive measures to improve their credit scores and enhance their financial opportunities.

Posting Komentar untuk "Map reveals cities with top and bottom credit scores"

Posting Komentar