Citigroup Surpasses 52-Week High: Is Now the Time to Invest?

Citigroup's Recent Performance and Strategic Moves

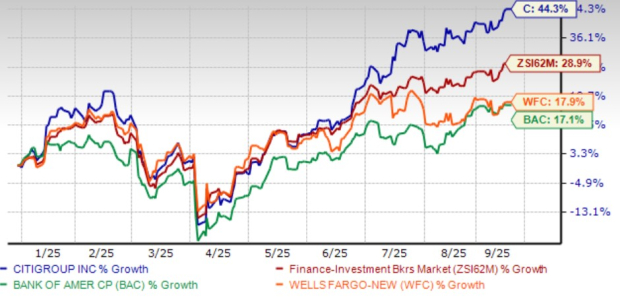

Citigroup, Inc. (C) reached a new 52-week high of $99.70 during the trading session on Friday, closing slightly lower at $99.44. Year to date, the stock has surged by 44.3%, outperforming the industry’s growth of 28.9%. This performance also surpasses that of its close peers, Bank of America (BAC) and Wells Fargo (WFC), which saw gains of 17.1% and 17.9%, respectively, over the same period.

Factors Driving Share Price Growth

The recent strength in Citigroup’s share price is largely attributed to optimism surrounding an expected Federal Reserve rate cut later this month. Signs of a softening labor market and slowing economic growth have fueled this expectation. According to the CME Fed Watch tool, 94.2% of market participants anticipate a 25-basis-point rate cut in the upcoming FOMC meeting.

When the central bank lowered rates last year by 100 basis points, Citigroup’s net interest income (NII) benefited significantly. In the first half of 2025, the company's NII rose 8% year over year. Further rate cuts are expected to ease pressure on funding and deposit costs, allowing the bank to maintain margins and capitalize on its expanding loan portfolio, which should boost future NII.

Management Guidance and Financial Outlook

During its second-quarter earnings release, Citigroup raised its 2025 NII guidance (excluding Markets operations). The bank now expects NII to grow 4% year over year in 2025, up from the previous estimate of 2-3%. In 2024, Citigroup’s NII stood at $54.9 billion.

Given this positive outlook, many investors are considering adding Citigroup stock to their portfolios. Let’s explore other factors that could influence its investment potential.

Focus on Core Operations

Citigroup has been concentrating on growth in its core businesses by streamlining its overseas operations. In April 2021, the company announced plans to exit the consumer banking business in 14 markets across Asia and EMEA. It has successfully exited from consumer banking businesses in nine countries.

Additionally, the company continues to wind down its Korean consumer banking operations and overall operations in Russia, as well as prepare for a planned initial public offering of its consumer banking and small business, and middle-market banking operations in Mexico. These initiatives will free up capital, enabling the company to invest in wealth management and investment banking (IB) operations, which will drive fee income growth.

Wealth management revenues have increased by 22% year over year, while IB revenues rose 13% in the first half of 2025. At the Barclays Global Financial Services Conference, Citigroup’s CFO, Mark Mason, noted “good momentum across all of our investment-banking products.” Management expects third-quarter 2025 IB fees and market revenues to increase in the mid-single-digit percentage point on a year-over-year basis. The company anticipates revenues to see a compounded annual rate of 4-5% by the end of 2026.

Cost Reduction Strategies

Citigroup has been emphasizing leaner, streamlined operations to reduce expenses. This includes changing its operating model and leadership structure, resulting in a more straightforward management structure aligned with increased spans of control and reduced bureaucracy.

In January 2024, Citigroup announced plans to cut 20,000 jobs or 8% of its global staff by 2026. The company has already made significant progress, reducing its headcount by more than 10,000 employees. It continues to focus on streamlining processes and platforms, using automation to reduce manual touchpoints. Citigroup is increasingly deploying artificial intelligence tools to support these efforts.

In the first half of 2025, total expenses declined nearly 1% year over year. Management expects expenses of $53.4 billion for 2025, suggesting a slight decline from the $53.9 billion reported in 2024. The company anticipates achieving $2-2.5 billion in annualized run rate savings by 2026.

Strong Liquidity Position and Capital Distribution

Citigroup maintains a strong liquidity position. As of June 30, 2025, cash and due from banks and total investments totaled $474.4 billion, while its total debt (short-term and long-term borrowing) was $373.3 billion. The company’s average Liquidity Coverage Ratio stood at 115% for the quarter ended June 30, 2025. Its common equity tier (CET) 1 capital ratio was 13.5% as of the same date.

Post-clearing the 2025 Fed stress test, the company increased its dividend by 7.1% to 60 cents per share. Over the past five years, it has raised its dividends three times, maintaining a payout ratio of 33%. Its dividend yield of 2.41% is above the industry average of 1.9%. Its peers, Bank of America and Wells Fargo, have a dividend yield of 2.21%.

In January 2025, Citigroup’s board of directors approved a $20-billion common stock repurchase program with no expiration date. As of June 30, 2025, $16.3 billion worth of authorization remained available. Supported by a strong capital and liquidity position, its capital distribution activities seem sustainable.

Valuation and Investment Potential

The Zacks Consensus Estimate for Citigroup’s 2025 and 2026 sales implies year-over-year rallies of 4.5% and 2.9%, respectively. The Zacks Consensus Estimate for 2025 and 2026 earnings indicates year-over-year increases of 27.6% and 27.8%, respectively. Estimates for both years have been revised upward over the past 30 days.

From a valuation standpoint, Citigroup appears inexpensive relative to the industry. It is currently trading at a discount with a forward 12-month price-to-earnings (P/E) of 10.95X, well below the industry average of 14.95X. Bank of America is trading at a 12-month forward P/E of 12.33X, whereas Wells Fargo is trading at 12.53X. Hence, Citigroup is trading at a discount compared with both.

Should You Buy Citigroup’s Stock Now?

Citigroup’s strong fundamentals, aggressive cost-cutting, and disciplined strategic refocus position it well for sustained growth. With robust liquidity, rising NII, and expanding wealth and investment banking revenues, the company is executing effectively while returning significant capital through dividends and buybacks.

Despite reaching a 52-week high recently, Citigroup still trades at a significant valuation discount to the industry, offering potential upside if management hits growth targets and the Fed starts easing rates.

As such, investors can consider parking their cash in Citigroup’s stock at the current level to generate a healthy long-term return.

Posting Komentar untuk "Citigroup Surpasses 52-Week High: Is Now the Time to Invest?"

Posting Komentar