IBD Stock Of The Day: S&P 500 Leader For AI Data Centers

GE Vernova: A Rising Star in the Energy Sector

GE Vernova has emerged as a standout stock, capturing attention as the IBD Stock Of The Day. The company, which is part of the S&P 500, has been trading in a buy zone, showing strong performance following a bullish upgrade from analysts who see significant upside potential. With energy demand expected to remain robust over the long term, GE Vernova is positioned for continued growth.

Analyst Upgrades and Optimism

Melius Research analyst Rob Wertheimer recently upgraded GE Vernova to a "buy" rating, raising his price target to 740 from a previous hold designation. Wertheimer highlighted that the stock has surged over 400% since General Electric completed its long-term restructuring last year. He also pointed out that there is considerable potential for positive surprises in sell-side estimates moving toward 2027 and beyond.

Jefferies analysts have also raised their price target for GE Vernova to 668, maintaining a hold rating. They noted that management expects consistent revenue performance through 2028 and suggested that any slowdown in revenue growth could impact the company’s valuation.

Morgan Stanley analyst David Arcaro expressed increased confidence in GE Vernova's long-term outlook after the Laguna Conference. He emphasized the growing demand for electricity driven by data center expansion, electrification across various industries, and global economic growth. These factors are expected to support prolonged electric demand, reinforcing the company’s strong position in the market.

Stock Performance and Chart Analysis

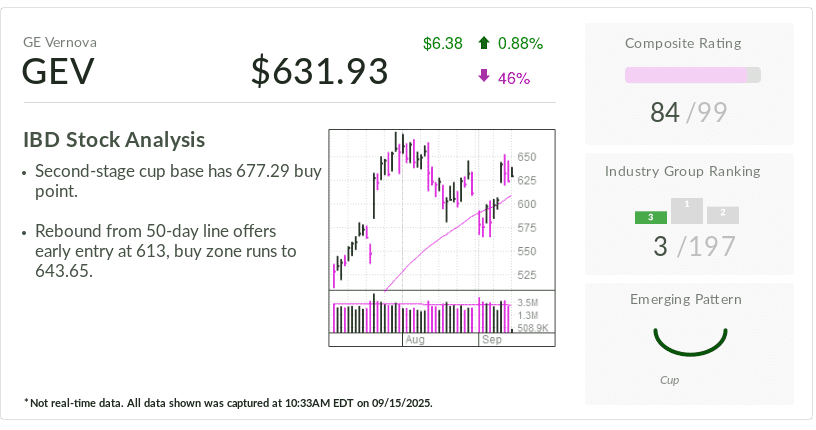

GE Vernova's stock increased by approximately 0.5% to 628.39 on Monday, following a 7.5% rise to 625.55 the previous week. According to MarketSurge charts, the stock has a traditional buy point at 677.29. Last week, the stock broke above the 50-day moving average, signaling a potential buy opportunity.

The stock is also featured on the IBD Leaderboard, with analysis suggesting a buy point at 613 and a buy zone extending up to 643.65. Investors may consider entering at the August 28 high of 646.95, as per chart analysis.

Strong Year-to-Date Gains

This year, GE Vernova has delivered a 92% gain, making it the fifth best-performing stock in the S&P 500 index as of Monday's market open. This impressive performance underscores the company's strong fundamentals and strategic positioning in the energy sector.

Earnings and Future Outlook

GE Vernova is scheduled to report its third-quarter earnings and revenue on October 22. In late July, the company reported Q2 earnings of $1.73 per share, a significant increase from 8 cents a year ago, with revenue rising 11% to $9.1 billion.

The company has also raised its 2025 outlook, projecting revenue at the higher end of its $36 billion to $37 billion range. Additionally, it has increased its free cash flow forecast to between $3 billion and $3.5 billion, compared to its previous estimate of $2 billion to $2.5 billion.

William Blair analyst Jed Dorsheimer praised GE Vernova as the "best name" in the AI power industry, noting that the company is performing exceptionally well. He highlighted that the company's natural gas turbine slot reservations are filling up through 2028, with nine gigawatts of new contracts added in Q2, bringing the total backlog to 55 gigawatts.

Key Ratings and Investor Tools

GE Vernova has an 84 Composite Rating out of a possible 99, reflecting its strong performance. It also boasts a 96 Relative Strength Rating and a 30 EPS Rating, indicating solid financial health and growth potential.

Investors interested in tracking top-performing stocks can refer to the IBD 50 list of growth stocks, the IBD SwingTrader, and the IBD Sector Leaders list. These resources provide valuable insights and help investors make informed decisions.

For those looking to deepen their understanding of stock market dynamics, tools like the IBD Digital platform offer access to premium lists, tools, and analysis. Whether navigating bull or bear markets, these resources can help investors refine their strategies and improve their outcomes.

Posting Komentar untuk "IBD Stock Of The Day: S&P 500 Leader For AI Data Centers"

Posting Komentar