PBYI Soars 30% in 3 Months: What's Next for Investors?

Strong Performance of Puma Biotechnology's Stock

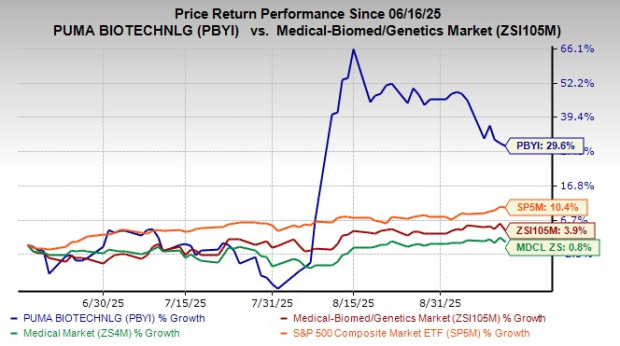

Over the past three months, Puma Biotechnology has shown impressive performance, with its stock rising by 29.6% compared to a 3.9% increase in the industry. The company's shares have outperformed both its sector and the S&P 500 index. This positive trend is evident from the chart provided.

The main reason for this surge in stock value is attributed to better-than-expected results released last month. Additionally, sales of Nerlynx, the company’s only marketed product, are on an upward trajectory, and there is growing optimism around its pipeline projects.

Enhancing Revenue Through Nerlynx Sales

Nerlynx (neratinib) is approved for treating early-stage HER2-positive breast cancer in patients who have previously received Herceptin-based adjuvant therapy. It is also approved in combination with Xeloda for certain patients with advanced or metastatic HER2-positive breast cancer. Currently, Nerlynx accounts for the majority of Puma Biotechnology's revenue.

Recent quarters have seen improved sales for Nerlynx. In the first half of 2025, sales increased by 9% year-over-year to $92.3 million. The company anticipates continued demand-driven growth in Nerlynx sales during the second half of 2025, which could further boost top-line growth.

Projected sales for Nerlynx in 2025 are expected to be between $192 million and $198 million.

Alisertib: A Promising Pipeline Candidate

Puma Biotechnology acquired global development and commercialization rights for alisertib, an aurora kinase A inhibitor, from Takeda in 2022. The drug is being developed for hormone receptor-positive breast cancer and small-cell lung cancer (SCLC).

The company is conducting a phase II study called ALISCA-Lung1, evaluating alisertib as a monotherapy for extensive-stage SCLC. Interim data from this study is expected in the fourth quarter of 2025.

Additionally, Puma Biotechnology is conducting a phase II study named ALISCA-Breast1, examining alisertib in combination with endocrine treatment for chemotherapy-naïve HER2-negative, hormone receptor-positive metastatic breast cancer. Initial data from this study is also anticipated in the fourth quarter of 2025.

If successfully developed, alisertib has the potential to enhance Puma Biotechnology's position in the anticancer drug market and reduce its reliance on Nerlynx for revenue.

Overdependence on Nerlynx and Market Competition

Puma Biotechnology currently has no other approved products besides Nerlynx, making it heavily reliant on this single product for revenue and growth. While the breast cancer market offers significant commercial potential, Nerlynx faces strong competition from established therapies like Herceptin and Tykerb.

Other companies are also developing treatments for extensive-stage SCLC, creating a competitive environment. Even if alisertib is successful, it may still face intense competition in its target market.

Valuation and Earnings Estimates

From a valuation perspective, Puma Biotechnology is trading at a discount relative to the industry. Using the price-to-sales (P/S) ratio, the company’s shares are currently valued at 0.94, lower than the industry average of 2.13. The stock is trading above its five-year mean of 0.73.

The Zacks Consensus Estimate for 2025 earnings per share has increased from 65 cents to 66 cents over the past 60 days. Similarly, estimates for 2026 have risen from 51 cents to 60 cents during the same period.

Conclusion and Investment Outlook

Puma Biotechnology's recent stock rally is a positive sign, driven by improving sales of Nerlynx and progress in its pipeline. Continued strong performance of Nerlynx and encouraging developments in the pipeline should support further momentum in 2025.

However, the competitive landscape remains a concern. Any setbacks in ongoing studies or regulatory challenges could impact growth prospects. Prospective investors are advised to take a wait-and-watch approach, while existing shareholders can consider holding their positions. Successful data readouts from alisertib studies will be crucial for the stock's future performance.

Other Biotech Stocks to Consider

Puma Biotechnology currently holds a Zacks Rank of #3 (Hold). In the biotech sector, there are better-ranked stocks such as ANI Pharmaceuticals (ANIP) and CorMedix (CRMD), both with a Zacks Rank of #1 (Strong Buy).

ANI Pharmaceuticals has seen its 2025 earnings per share estimates rise from $6.53 to $7.25 over the past 60 days, with a 76.7% year-to-date gain. Its earnings have consistently beaten estimates in the last four quarters.

CorMedix has also shown improvement, with 2025 earnings per share estimates moving up from $1.10 to $1.52, and a 59.7% year-to-date gain. Its earnings have exceeded expectations in the last four quarters.

These stocks represent strong opportunities in the biotech sector, offering potential for growth and positive returns.

Posting Komentar untuk "PBYI Soars 30% in 3 Months: What's Next for Investors?"

Posting Komentar