Alphabet's AI Revolution: What Lies Ahead by 2035?

Alphabet's Transformation into an AI and Cloud Powerhouse

Alphabet, the parent company of Google, is one of the most influential names in the technology sector. As it moves forward, the company is entering a new phase driven by artificial intelligence (AI), increased cloud adoption, and consistent demand across its core services like Search, YouTube, Android, and Workspace. While Alphabet is already a massive entity, the next decade could redefine how it generates revenue and how quickly it expands.

Strong Financial Performance in Q3 2025

In the third quarter of 2025, Alphabet achieved a significant milestone by reporting more than $100 billion in quarterly revenue for the first time. The total came in at approximately $102.3 billion, representing a 16% increase from the previous year. This growth was largely fueled by strong AI-driven performance in Google Cloud, which provided a clearer glimpse into the company’s potential trajectory by 2035.

AI and Cloud as Key Drivers of Growth

Alphabet is shifting its focus toward AI and cloud computing, with both playing increasingly important roles in its operations. Recent developments, such as the launch of Gemini 3 and reports that Meta is exploring Google’s Tensor Processing Units (TPUs), highlight the growing influence of AI within the company. In Q3 2025, Google Cloud revenue surged by 34% year over year to about $15.2 billion, driven by rising demand for AI training and data tools.

The company has integrated AI into nearly every major product, including Search, YouTube, Chrome, Android, and Workspace. These platforms reach billions of users, allowing Alphabet to deploy AI features on a scale that few competitors can match. If AI demand remains robust, cloud services could become a larger portion of Alphabet’s revenue mix by 2030.

Improving Profitability Through Efficiency

Over the past few years, Alphabet has prioritized efficiency, implementing cost-cutting measures, restructuring teams, and increasing automation. These efforts, combined with stronger sales, have contributed to improved profit margins in 2025.

In Q3 2025, Alphabet reported an operating margin of around 30.5%. Excluding a significant fine, the margin was close to 33.9%, up from just over 32% in the previous year. Google Cloud also saw improved profitability, with operating income reaching approximately $3.6 billion during the quarter. Cloud margins were in the mid-20% range, compared to the high teens in 2024.

If these trends continue, Alphabet may experience higher profits in the coming years.

A Future Shaped by AI and Cloud

By 2035, Alphabet is expected to look much different from the ad-focused business it is today. Google Cloud could take on a significantly larger share of revenue as demand for AI training, data processing, and enterprise tools continues to grow. AI will be central to Search, YouTube, Android, and Workspace, enabling Alphabet to generate more value from its vast user base.

While growth may slow as the company becomes larger, Alphabet could become more stable, efficient, and focused on high-value cloud and AI services.

Is GOOGL Stock a Good Investment?

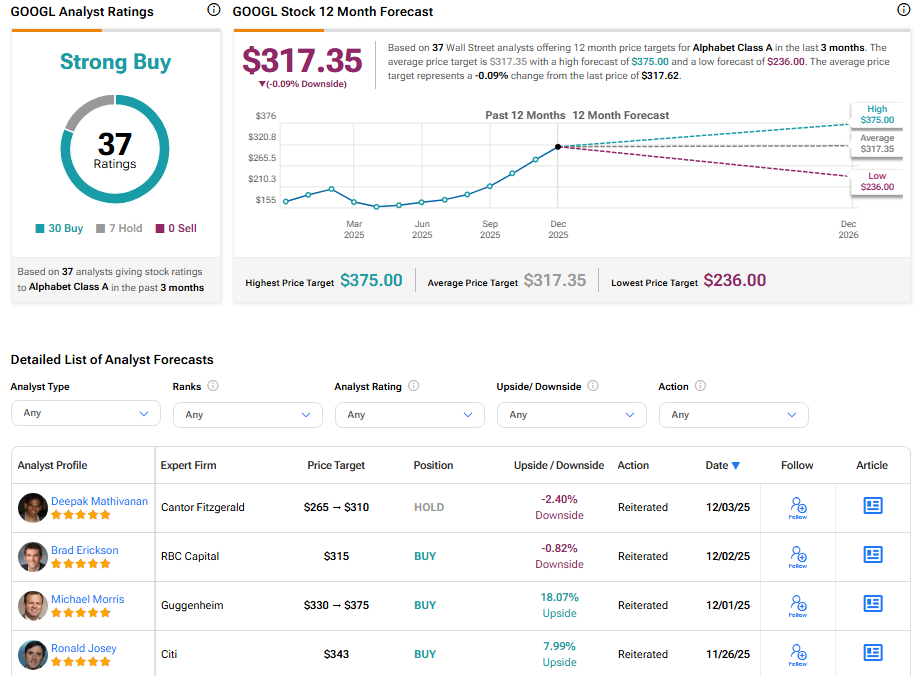

Currently, Wall Street maintains a "Strong Buy" consensus rating for Alphabet stock, based on 30 buy recommendations and seven hold ratings. The average price target for GOOGL is $317.35, suggesting that shares are fully priced at current levels.

See more GOOGL analyst ratings.

Disclaimer & Disclosure

Report an Issue

Posting Komentar untuk "Alphabet's AI Revolution: What Lies Ahead by 2035?"

Posting Komentar