Crypto stocks fall as debt pressure grows and token values struggle

The Struggles of Public Firms Investing in Cryptocurrency

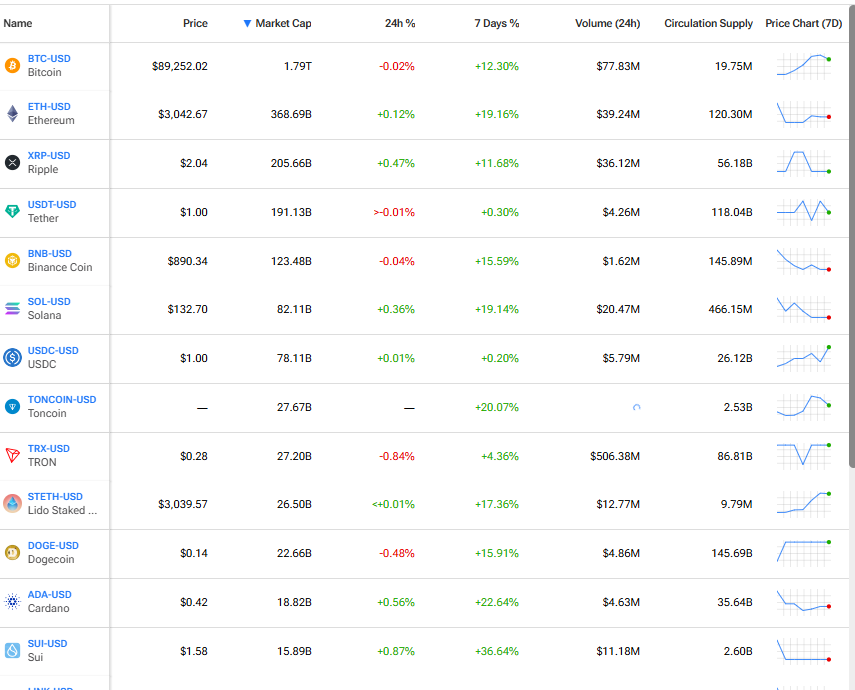

Public companies that have ventured into the world of cryptocurrency as a means to boost their stock value are now facing significant challenges. Initially, these digital asset treasuries experienced rapid growth and attracted widespread attention. However, as the year progressed, many of these firms saw their stock prices decline sharply. The median stock price for U.S. and Canadian firms in this group has dropped by 43% in 2025, while Bitcoin (BTC) has only fallen by 4%.

A Lesson to be Learnt

One notable example is SharpLink Gaming (SBET), which initially gained momentum after announcing a shift from its previous focus on games to using new cash to purchase large amounts of Ethereum. At one point, its stock surged by over 2,600%. However, the gains were short-lived, and the stock eventually plummeted by 86%. The firm now trades at nearly 0.9 times its Ether holdings. Another example is Greenlane Holdings (GNLN), whose shares fell by over 99% despite holding around $48 million in BERA tokens.

According to Fedor Shabalin, an analyst at B. Riley Securities, “Investors took a look and understood that there’s not much yield from these holdings rather than just sitting on this pile of money.” As a result, stock prices declined. Many of these firms had used debt to acquire these tokens, and now they must make interest or dividend payments. Since cryptocurrency does not generate cash flow, each firm must either use its own funds or sell tokens to cover these obligations.

Debt Strain Builds

Strategy (MSTR) was among the first to set the trend by using extensive rounds of bonds and preferred shares to purchase large sums of Bitcoin. At one point, its token holdings reached over $70 billion. As more firms followed suit, the group raised more than $45 billion to buy crypto. However, each firm now faces the costs associated with these deals.

Michael Lebowitz, a manager at RIA Advisors, stated, “If you own a Strategy, you own the Bitcoin risk plus whatever kind of corporate stress corporate risk they are taking on.” Strategy attempted to raise fresh capital in Europe through new preferred shares, but these soon fell below the offer price. The firm later established a $1.4 billion reserve fund to help with near-term costs. Despite this, its stock is down 38% this year. Its chief executive, Phong Le, acknowledged, “We can sell Bitcoin, and we would sell Bitcoin if we needed to fund our dividend payments.”

As cryptocurrency prices stabilize, it has become increasingly difficult for smaller firms to secure new funding. Some may be forced to sell tokens to cover costs, which could further strain the broader market. However, some deals are still happening. Strive Inc. recently agreed to acquire Semler Scientific Inc. in a stock deal. Ross Carmel of Sichenzia Ross Ference Carmel also noted that more mergers may take place in early 2026, with new strategies aimed at providing greater downside protection for investors.

Posting Komentar untuk "Crypto stocks fall as debt pressure grows and token values struggle"

Posting Komentar