VC Roundup: Big Money, Few Deals as Crypto Funding Slumps

Overview of Venture Capital Funding in the Cryptocurrency Sector

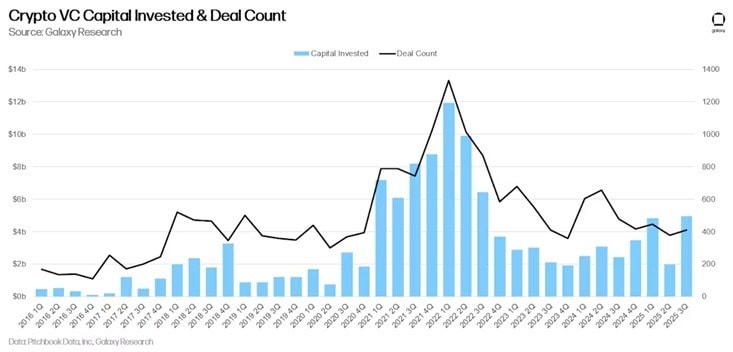

In November, venture capital funding in the cryptocurrency sector remained relatively quiet, continuing a broader slowdown that has been evident throughout late 2025. This trend has seen deal activity concentrated primarily among established companies that are raising significant amounts of capital.

As previously reported, the third quarter also displayed a similar pattern. According to Galaxy Digital, total funding reached $4.65 billion, but the number of deals did not keep pace. Instead, the majority of capital flowed towards larger, more mature firms.

Continued Divergence in Deal Activity

November mirrored this divergence. RootData data showed only 57 disclosed crypto funding rounds during the month — one of the weakest totals of the year. This was despite notable fundraising events such as Revolut’s $1 billion round and Kraken’s $800 million raise ahead of its anticipated initial public offering.

Most of the deals in November were focused on centralized finance, decentralized finance, and NFT–GameFi sectors. While some of the decline in deal volume can be attributed to broader market conditions, industry experts warn that this trend could pose longer-term risks.

Sarah Austin, co-founder of the real-world-asset gaming platform Titled, highlighted the implications of this trend. “Ultimately, this has a negative consequence on the entire industry because investing in tough times is when the best deals are made,” she said.

Notable Funding Deals

The latest edition of VC Roundup highlights three significant funding deals across the decentralized perpetuals, onchain-yield, and Web3–AI sectors.

Ostium Secures $24 Million to Scale Onchain Perpetuals Protocol

Ostium, a decentralized perpetuals platform founded by former Harvard classmates, has raised $24 million in new funding to scale its onchain perpetuals protocol across non-crypto markets such as stocks, commodities, indexes, and currencies.

The funding supports the company’s broader push to position Ostium as a leading perpetuals protocol for real-world assets. This expansion aims to provide access to traditional markets through self-custodial infrastructure.

Ostium stated that the capital will be used to strengthen its underlying systems, including smart contracts, pricing infrastructure, and liquidity engines, to support higher trading volumes.

The company is backed by investors including General Catalyst, Jump Crypto, Susquehanna International Group, and angel investors from Bridgewater, Two Sigma, and Brevan Howard.

Axis Raises $5 Million for Onchain Yield Protocol

Onchain revenue protocol Axis has raised $5 million in a private funding round led by Galaxy Ventures. The company is preparing to launch an onchain yield protocol that offers exposure to Bitcoin (BTC), gold, and the US dollar.

Axis mentioned that the capital will support the development of what it describes as a transparent, onchain yield infrastructure for digital assets.

The round also included participation from OKX Ventures, Maven 11 Capital, CMS Holdings, and FalconX, among other investors. Axis noted that $100 million in private capital from investors has already been deployed through its beta platform to stress-test the protocol’s engine.

PoobahAI Closes $2 Million Seed Round for No-Code Platform

PoobahAI, a Texas-based startup, has raised $2 million in seed funding to expand its no-code development platform. The company’s tools allow creators, developers, and businesses to launch onchain ecosystems and deploy AI agents without technical expertise.

The emerging AI–Web3 ecosystem, which combines artificial intelligence with decentralized infrastructure, is viewed as a means to create more autonomous and user-controlled digital systems, enabling applications to operate without centralized oversight.

The round was led by FourTwoAlpha, a venture firm known for early investments in Ethereum and Cosmos.

Posting Komentar untuk "VC Roundup: Big Money, Few Deals as Crypto Funding Slumps"

Posting Komentar