Buy Marvell Technology as a 2026 AI Chip Dark Horse

Strong Earnings Performance and Strategic Growth

Marvell Technology Inc. (MRVL), a leading fabless designer, developer, and marketer of analog, mixed-signal, and digital signal processing integrated circuits for artificial intelligence (AI) infrastructure, reported strong third-quarter fiscal 2026 earnings results. The company’s quarterly earnings per share (EPS) of $0.76 per share exceeded the Zacks Consensus Estimate by 1.3%. Total revenues reached $2.08 billion, surpassing the Zacks Consensus Estimate by 0.61%.

The storage market is witnessing a steady increase in demand due to the rapid growth of data volume, particularly the exponential rise in unstructured data. The completion of inventory digestions is expected to support MRVL's growth across enterprise networking and carrier infrastructure end markets.

Solid Business Growth

Third-quarter revenues grew by 36.8% year over year, driven primarily by strong performance in the data center and continued recovery in enterprise networking and carrier infrastructure end markets.

Data center revenues reached $1.52 billion, an increase of 37.8% year over year and 1.8% sequentially. This growth was fueled by strong traction in custom XPU silicon, electro-optic interconnect products, and next-generation switch offerings. The data center segment contributed 73.2% of total revenues, reinforcing its position as MRVL’s largest end market.

Revenues from enterprise networking rose by 57% year over year and 23% sequentially to $237.2 million, accounting for 11.4% of total revenues. The robust growth was primarily due to the continued normalization of inventory levels.

Carrier infrastructure revenues increased by 98% year over year and 29% sequentially to $167.8 million, representing 8.1% of total revenues. This growth was driven by a recovery in demand across carrier customers.

Custom AI silicon and electro-optics products have positioned MRVL as a critical player in high-performance computing. The company’s partnerships with leading hyperscalers ensure sustained growth, with management confident that revenues from its custom XPU (accelerated computing) solutions will continue expanding in fiscal 2027 and beyond.

Expansion Through Acquisition

MRVL announced the acquisition of Celestial AI, which is expected to close in the first quarter of fiscal 2027. Celestial AI specializes in the Photonic Fabric technology platform, designed for scale-up optical interconnects.

MRVL highlighted that Celestial AI is “deeply engaged” with several hyperscalers and ecosystem partners. Celestial AI has already secured a major contract with one of the largest hyperscalers, who plans to use the photonic fabric chiplets in its next-generation scale-up architecture.

Hyperscalers are also central to the company’s other product lines. MRVL is pushing boundaries with 400G per lane PAM technology, enabling 3.2T optical interconnects and future-proofing hyperscaler infrastructure.

This acquisition will place Marvell in a strong position in the next-generation energy-efficient AI infrastructure space, allowing it to compete with industry leaders like NVIDIA Corp. (NVDA) and Broadcom Inc. (AVGO).

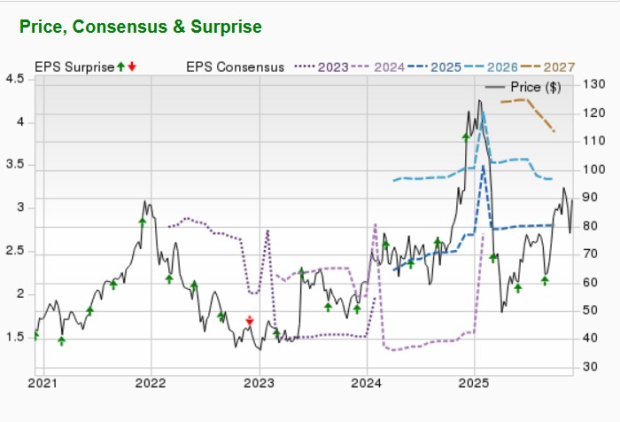

Strong Guidance

MRVL provided strong revenue guidance for the fourth quarter, expecting revenues to be $2.20 billion (+/- 5%). The Zacks Consensus Estimate for revenues is pegged at $2.15 billion, indicating an 18.52% year-over-year improvement. Marvell expects data center revenue growth to be higher next year, reflecting accelerating AI demand.

The company projects non-GAAP earnings per share for the fiscal fourth quarter to be $0.79 (+/- $0.05). The Zacks Consensus Estimate for this figure is $0.78, suggesting a 30% year-over-year improvement.

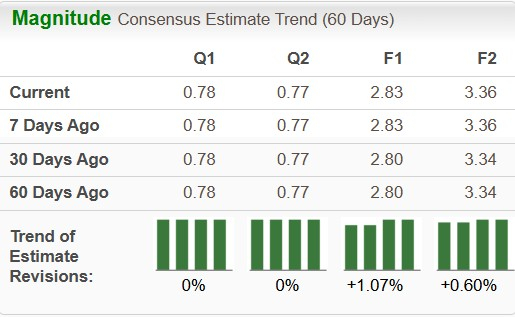

Attractive Estimate Revisions

MRVL has an expected revenue and earnings growth rate of 15.3% and 18.9%, respectively, for next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved by 0.6% in the last 30 days.

Marvell currently carries a long-term (3-5 years) EPS growth rate of 38.2%, significantly higher than the broad-market index — the S&P 500 — long-term growth rate of 16.1%.

Image Source: Zacks Investment Research

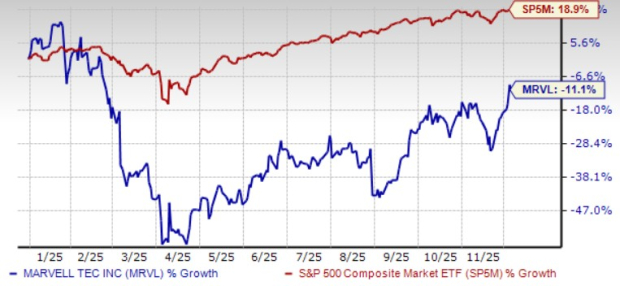

Excellent Valuation

Marvell Technology currently carries a Zacks Rank #2 (Buy). Year to date, the stock price of Marvell Technology has been through a rough patch, falling more than 11% in 2025. The stock is currently trading at a 21.4% discount to its 52-week high. MRVL currently carries a forward P/E of 32.8% compared with 34% of its peers’ average. Return on equity is 15.2% compared with 2.9% of the industry.

Image Source: Zacks Investment Research

Future Prospects

Strong growth in MRVL’s data center, enterprise networking, and carrier infrastructure revenues, coupled with the proposed acquisition of Celestial AI, could be a game changer for the company. Consequently, the stock could be a potential dark horse in Wall Street’s AI infrastructure race.

Image Source: Zacks Investment Research

Posting Komentar untuk "Buy Marvell Technology as a 2026 AI Chip Dark Horse"

Posting Komentar