Texas invests $5 million in crypto reserve launch

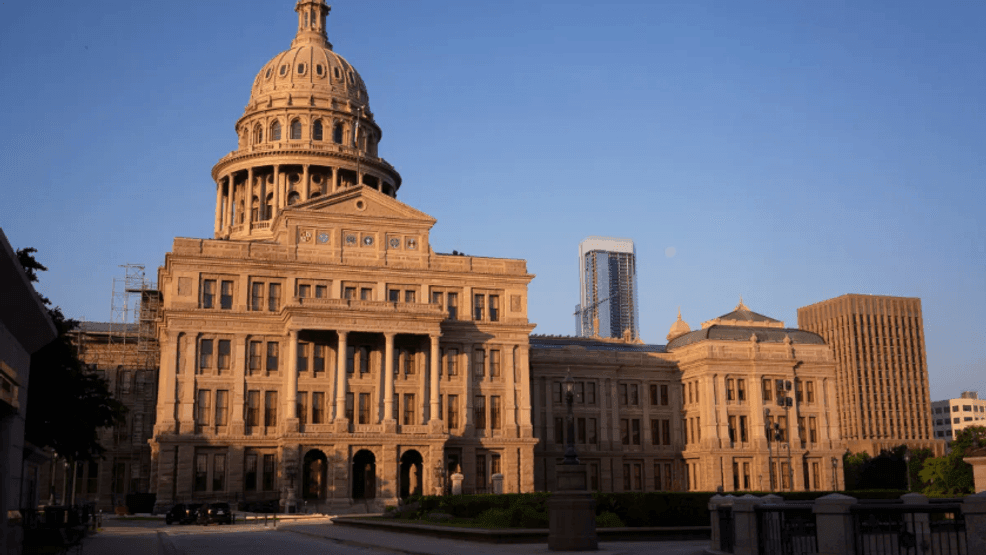

Texas Launches State Cryptocurrency Reserve with $5 Million Bitcoin Purchase

Texas has taken a bold step into the world of digital currency by launching its new cryptocurrency reserve with a $5 million purchase of Bitcoin. This move marks one of the first instances of a state government investing in a volatile and often controversial asset, as the state continues to embrace the potential of cryptocurrencies.

The Texas Comptroller’s Office confirmed that the purchase was made last month as a “placeholder investment” while the office works on contracting with a cryptocurrency bank to manage its portfolio. The decision comes amid a growing interest in digital currencies, particularly as the price of Bitcoin has seen significant fluctuations this year.

The purchase is part of a broader legislative effort, as the Texas Legislature passed a mandate to create the nation's first Strategic Bitcoin Reserve. Acting Comptroller Kelly Hancock emphasized the goal of building a secure reserve that strengthens the state’s balance sheet, highlighting Texas’ leadership in this emerging field.

This initial investment represents half of the $10 million allocated for the strategic reserve during this year’s legislative session. However, it is just a small fraction of the state’s overall $338 billion budget. Despite its size, the purchase is notable as it makes Texas the first state to fund a strategic cryptocurrency reserve. Arizona and New Hampshire have also passed laws to create similar funds but have not yet made any purchases. In contrast, Wisconsin and Michigan made pension fund investments in cryptocurrency last year.

The Comptroller’s office purchased the Bitcoin on the morning of November 20 when the price of a single Bitcoin was $91,336. As of Friday afternoon, the price had slightly dropped to $89,406, reflecting the inherent volatility of the market.

Some experts have raised concerns about the wisdom of the investment. Ed Hirs, an energy economist at the University of Houston, questioned the state’s decision, pointing to Bitcoin’s volatility. He argued that such an investment may not be prudent compared to more traditional options like stocks and bonds.

“Ordinary investment mixes aim to avoid volatility,” Hirs said. “The goal is to not lose to the market. If the public decides this has no intrinsic value, then taxpayers will be left holding the bag.”

Despite these concerns, others believe the investment is a sound move. Lee Bratcher, president of the Texas Blockchain Council, argued that Bitcoin has shown an upward trend since its inception in 2009. He believes that over time, the volatility of the asset will smooth out, potentially benefiting the state’s finances.

Bratcher also pointed out that the timing of the purchase was strategic, as he believes it is unlikely that Bitcoin will be valued this low again in the near future.

Crypto Industry Gains Ground in Texas

The investment comes at a time when the crypto industry has found a strong foothold in Texas. Rural counties have become hubs for crypto mining following China’s ban on crypto mining in 2021. Governor Greg Abbott’s declaration that “Texas is open for crypto business” further solidified the state’s position as a leader in the industry.

According to the Texas Blockchain Council, the state is home to at least 27 Bitcoin facilities, making it the top spot for crypto mining globally. Two of the largest crypto mining facilities in the world are located in Texas.

However, the rapid growth of the industry has not been without controversy. Critics highlight the significant energy consumption of crypto mines, which used 2,717 megawatts of power in 2023—enough to power roughly 680,000 homes. A 2023 study by Wood Mackenzie found that increased demand from crypto mines has led to a 5% rise in electric bills for Texans, or about $1.8 billion annually.

Residents living near these facilities have also voiced concerns about the lack of promised job creation and the noise generated by their operations.

State Senator Molly Cook, who opposed the creation of the strategic fund, argued that Texas should focus on long-term economic investments rather than what she described as a “gamble” on a volatile asset.

In contrast, State Senator Charles Schwertner, who authored the bill creating the fund, emphasized that the initiative would allow Texas to lead and compete in the digital economy.

Posting Komentar untuk "Texas invests $5 million in crypto reserve launch"

Posting Komentar