US Investors Bet Big on China's AI Amid Congressional Concerns

U.S. Investors Continue to Invest in Chinese AI Companies

Despite the growing tensions between Washington and Beijing over artificial intelligence (AI), U.S. investors are showing a strong interest in Chinese companies that are developing AI technologies. This has led to an increase in share prices for these companies and a surge in investments in exchange-traded funds (ETFs) that track the broader tech sector in China.

Several venture-capital firms based in China are raising U.S. dollar-denominated funds to invest in AI-related projects. Additionally, U.S. endowments that have previously avoided investing in China are now considering a return to the market, according to fund managers.

The momentum is driven by several factors, including the performance of Chinese AI models, such as those developed by DeepSeek, which have shown they can compete with their U.S. counterparts. Public-market investors are particularly drawn to the opportunities in China, as they face no restrictions on buying public shares of Chinese companies involved in AI.

Jialong Shi, head of China internet equity research at Japanese bank Nomura, stated, “China is such a huge market. We are going to see increasing fund inflow from the U.S. investors.”

Alibaba's Rise and Investment Trends

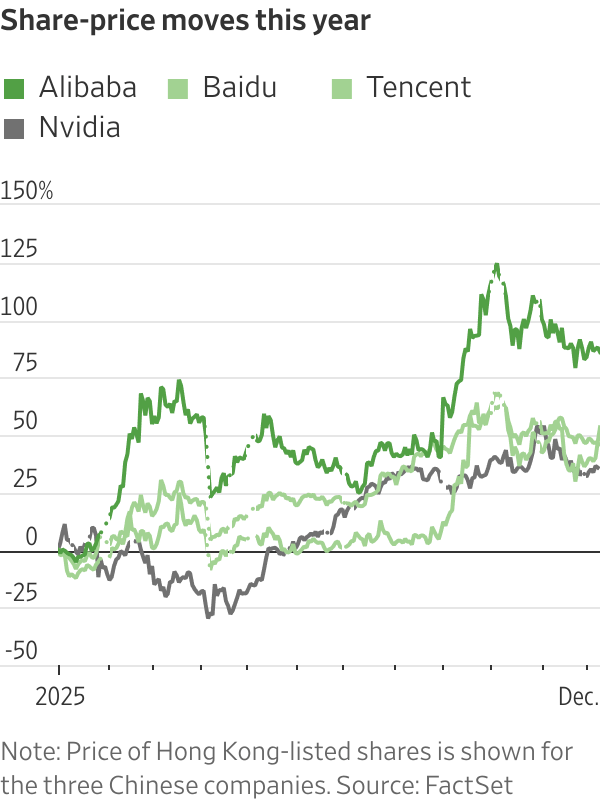

Shares of internet giant Alibaba, listed in Hong Kong and New York, have risen more than 80% this year, reaching a four-year high. The company plans to invest $53 billion over three years to build out AI infrastructure and pursue artificial-general intelligence.

While the U.S. still holds an edge in producing the most powerful AI models, Chinese companies have already begun to apply AI widely. Funds managed by U.S. players such as Vanguard Group, BlackRock, and Fidelity have increased their stakes in Alibaba’s Hong Kong-listed shares.

Shares in other Chinese tech companies like Tencent and Baidu, which are deploying large-language models at the core of generative AI, have also seen significant gains, rising nearly 50%.

Investment Opportunities in Chinese Tech Giants

London-based investment firm Ruffer sees more upside in listed Chinese tech giants because their price-to-earnings ratios are lower than those of U.S. peers such as Google parent Alphabet. Ruffer’s £19 billion portfolio, which includes money from U.S. investors, has grown nearly 11% this year, partly due to its stake in Alibaba.

Gemma Cairns-Smith, an investment specialist at Ruffer, said, “China is a big player in AI. It does trade at a big discount to its U.S. counterparts,” adding that “investors risk missing out.”

Billionaire hedge-fund manager David Tepper has been publicly bullish on Chinese companies this year. Alibaba was the biggest constituent of his firm Appaloosa’s disclosed listed investments, making up 16% of roughly $7 billion in public equities investments, according to a securities filing.

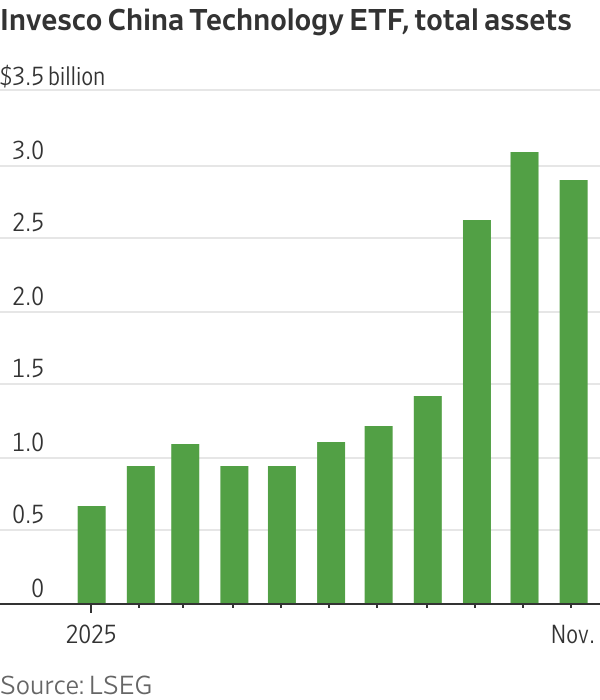

BlackRock reported that capital flows into ETFs tracking the broader tech sector in China have outpaced those in the U.S. this year, with U.S. investors making up 15% of the money moving into China tech ETFs in July.

Since then, two major funds tracking Chinese stocks have grown further. The size of New York-based KraneShares CSI China Internet ETF has increased by $1.4 billion to nearly $9 billion, and U.S.-listed Invesco China Technology ETF has more than doubled to nearly $3 billion, according to LSEG.

Growing Interest in China's AI Sector

Laura Wang, a Hong Kong-based equity strategist at Morgan Stanley, visited the U.S. in the fall to market opportunities in China and noted that 90% of investors in meetings wanted to increase exposure to China—the highest interest in four years—due to the growing attraction of Chinese companies in AI-powered robots and biotech.

Fred Hu, CEO of Primavera Capital, said, “There’s a tremendous amount of interest and intellectual curiosity which wasn’t there even a year ago.”

Global investors had largely fled China in recent years due to concerns about strict pandemic rules, regulatory crackdowns on tech companies, and a property bust that dampened economic growth. U.S. venture capital became entangled in U.S.-China geopolitical tensions, leading to a collapse in funding for Chinese private companies.

Some venture firms that had teams in both the U.S. and China, such as Sequoia Capital, were forced to split their operations and rebrand. However, China-based funds have raised U.S.-dollar funds this year, hoping to capitalize on renewed enthusiasm for China’s AI story.

Monolith Management, a venture firm founded by a former Sequoia Capital China investor, recently raised nearly $300 million to invest in early-stage startups, while Qiming Venture Partners, a longstanding China-focused venture-capital firm, is raising a dollar-denominated fund.

Challenges and Geopolitical Concerns

Despite the growing interest, venture capitalists note that most of the money for U.S. dollar-denominated funds this year has come from Europe, the Middle East, and the rest of Asia. Yihao Li, founding partner of Creekstone Ventures, a Shanghai-based venture-capital firm currently raising a fund, said, “It’s quite clear that when it comes to AI, China and the U.S. are basically the only places investors can really look at.”

However, he added, “For investors in private Chinese companies, the major challenge remains the geopolitical issue.”

The Biden administration prohibited investments into private Chinese companies in certain high-tech fields, including quantum computing and AI models above technical thresholds. A push to widen these limits is moving ahead in Congress, even after Trump and Chinese leader Xi Jinping agreed on a trade truce in October.

The National Defense Authorization Act, approved by the House on Wednesday, will enable Trump to add hypersonic-weapon technology to the prohibited list and require more disclosure of how U.S. investors are aiding Chinese AI.

Posting Komentar untuk "US Investors Bet Big on China's AI Amid Congressional Concerns"

Posting Komentar